Get Your Fineday Funds Up To $5000

How much do you need?

Tell about yourself

Complete our online form with some basic information, and we'll find a lender that is ready to meet your interests. All your data is safe with us.

Get offers

We do not force you to accept any offer until you're completely satisfied with one. Shop around to compare prices and check what rates and amount you can qualify for.

Receive your money

Once you're approved, finalize your loan with the lender and have your funds deposited directly to your bank account.

Finedayfunds Customer Service

Online Payday loan as much as $1,000 in Fast Moment. – Finedayfunds Customer Service,Right Deposited within 24+ hr. – Rapidly & Straightforward…

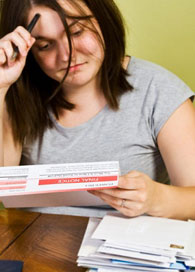

Do you need cash fast? Bills overwhelming your life? Maybe you have thought about getting a payday loan in order to stay afloat. Although they can be a valid option for some people, it is important to get all the facts. This article will provide you with advice to enlighten you on Finedayfunds Customer Service .

Do you need cash fast? Bills overwhelming your life? Maybe you have thought about getting a payday loan in order to stay afloat. Although they can be a valid option for some people, it is important to get all the facts. This article will provide you with advice to enlighten you on Finedayfunds Customer Service .

Our company offers $1,500 within Quickly Moment. – Finedayfunds Customer Service – Easy Credit assessment & Faxless. On the web Software. – Most effective Acceptance. – Utilize On the internet This evening.

Make sure that you understand exactly what a payday loan is before taking one out. These loans are normally granted by companies that are not banks; they lend small sums of money and require very little paperwork. The loans are accessible to most people, although they typically need to be repaid within two weeks.

When you get your first payday loan, ask for a discount. Most payday loan offices offer a fee or rate discount for first-time borrowers. If the place you want to borrow from does not offer a discount, call around. If you find a discount elsewhere, the loan place, you want to visit will probably match it to get your business.

Understand what APR means before agreeing to a payday loan. APR, or annual percentage rate, is the amount of interest that the company charges on the loan while you are paying it back. Even though payday loans are quick and convenient, compare their APRs with the APR charged by a bank or your credit card company. Most likely, the payday loan’s APR will be much higher. Ask what the payday loan’s interest rate is first, before you make a decision to borrow any money.

If you must get a loan from a payday loan agent, look around for the best deal. Time might be ticking away and you need money in a hurry. Take an hour or so to research several options and find one with a lower interest rate than the others. By taking a little bit of time beforehand, you can be better prepared to handle what’s in store for you down the road.

Be cautious with handing out your personal information when you are applying to get a payday loan. It isn’t uncommon for applications to ask for items like your address and social security number, which can make you susceptible to identity theft. Verify that the company has a legitimate privacy policy and is a reputable lender.

Payday lenders are really picking up in terms of locations and even loan options, so they might be very tempting for you. Payday loans allow you to borrow money without the hassle of a credit check. It is usually a very short-term loan. Since these loans are often short term in nature, they come with really high interest rates. Still, those in an emergency might need them.

There are some payday loan companies that are fair to their borrowers. Take the time to investigate the company that you want to take a loan out with before you sign anything. Many of these companies do not have your best interest in mind. You have to look out for yourself.

Advance loan throughout Instantaneously. – Speedy request ends in seconds. : Finedayfunds Customer Service – Quick Approval. – Get Now.

The inability to pay your bills is a crushing feeling. Finedayfunds Customer Service The advice you’ve received here should help you pay those bills and get back on your feet.